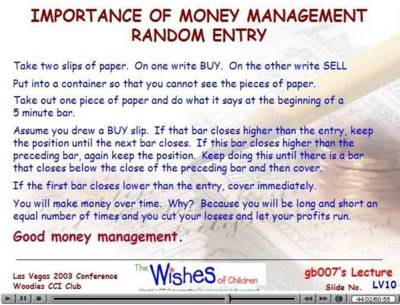

Great Woodie-related lectures can be found here. This is from gb007's lecture on "Discipline & Money Management"

Another key thing I got from the lecture is that most traders spend 85% on their charts and only 15% on mastering discipline/money management. Successful traders do the opposite, spending 85% of their time on discipline/money management and only 15% on their charts. One may quibble with the percentages, but the bottomline seems pretty much on point. I know I'm certainly guilty of being a chart maniac. I study chart setups until my eyes explode. I do playbacks on the weekends and after the markets close each afternoon. I fool around with indicators, adding/removing them, then removing/adding them. I mess around with the colors, fonts, etc. You get the picture. All the while, none of that improves my trading results. They're just distractions used as time-killing crutches to convince myself that I'm keeping my head in the game and doing something useful. It's all a resounding lack of discipline and focus.

The charts are the charts. Honestly, staring at them just during market hours everyday is more than enough acquaintance needed. It's all probabilities, and a successful trader just needs an edge. Proper money management takes care of the rest.

Note to self: spend more time "studying" discipline and money management. Focusing so much on the charts is actually self-defeating. Traders think everything's in the charts, and forgetting that while the charts should look the same to everyone, traders are going long and short, taking profits and getting killed all at the same time every moment of the market day. Something obviously is happening out there beyond the charts, and it's happening in everyone's head. I can't look into everyone's thoughts in the markets, but I can delve further into mine (scary as that seems).

Daytrader, heal thyself. I'll try.

0 Comments:

Post a Comment

<< Home