It's FOMC Tuesday, and I've been on the sidelines this morning. Looks like we had a little pop when Bush started talking at the UN, but that's flattened out.

If you're into market and trading psychology, visit Innerworth.com. You can sign up for daily emails where they send you the "feature article" for the day. I usually let them accumulate, then read them on the weekends. I'm plowing thru some now. Here are some samples from the past week's articles:

"There are three key strategies the novice traders can use to persist in the face of adversity: (1) Cultivate a fighting spirit, (2) set up an alternative reward system, and (3) focus on the process not the prize."

"Accepting what you can and cannot control can do wonders for your outlook. There's a sense of freedom that comes with knowing one's limitations. The more you can accept what the markets can offer you, rather than you trying to unrealistically control the markets, the more profitably you will trade."

"Throughout our lives, we learn that our value as people depends on what we do, and often, how well we do it. Our parents may have implied that they would not fully love us unless we did what they wanted. Only when we were "good children" did our parents love us fully. Our teachers may have often told us that if we didn't follow the rules, we weren't "good students" or "good citizens." Eventually, we arrived at the conclusion that we were only as good as what we accomplished in life. Our job, the amount of money we make, the car we drive, the house we own, and the neighborhood we live in are all indicators of "success." We tend to believe that they are the ultimate measure of our worth, and that if we were to "make it," we would gain the respect of our friends and loved ones... It may seem ironic, but in the end, it is essential that you isolate your feeling of worth as a person from your performance as a trader. If you put your self-esteem on the line with your money, you'll choke in the end. If you can separate your self-worth from your net worth, you'll trade more profitably and consistently."

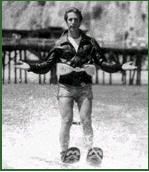

"Trading is much like learning a risky sport, such as motocross, skateboarding, or skiing. In these sports, you play by yourself and try to stretch the limits. But if you try to perform beyond your skill level, you'll get hurt. If you try to make a jump before you even know how to maneuver around basic obstacles, in all likelihood, you'll fail when you make an attempt. It's better to take it slowly. Build up your skills through practice and preparation before trying something too difficult. This is a commonsense approach, but when it comes to trading, few follow it."

"All animals, even humans, need a reward before they act. Why do something if you can't get something out of it? Our strongest motives are to satisfy physical needs, such as hunger. When an animal is hungry, for example, it is willing to go to great lengths to find food. Humans are a little more complicated, however. We can, and usually are required to, postpone the gratification of our needs. We don't need to eat immediately just because we are hungry. We can put it off until the appropriate time. We can also replace a natural reward, such as food, with a symbolic reward, such as money to purchase a savory meal. Money is a powerful motivator, and that's why it is so strongly associated with emotions, such as fear and greed."

If you're into this kind of stuff like I am, then definitely sign up for the emails.

0 Comments:

Post a Comment

<< Home