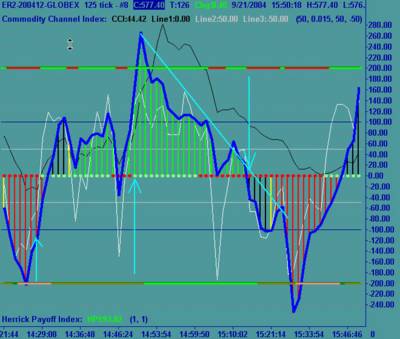

Sierra's 125 tick chart which I use to emulate the Esig 250 volume chart used by Woodie.

3 paper trades today (3-0-0) for +$100 (-$14.40 comm)

Things got slow as molasses today as the markets waited for the FOMC rate hike announcement. Volume seriously dried up midday, but I knew we'd have the usual flurry of trades post-announcement so I keyed on the 125 tick which would be good for some afternoon CCI squiggles. I only took 3 trades today, all within 45 minutes, as that was all I could muster up for a window of heavy duty concentration after letting my brain rot most of the day on the sidelines. I missed a fill on another nice ZLR short which was at the tail end of the trendline shown and called it a day.

My personal debate question of the day: Is it all about the Benjamins?

Newbie traders are advised not to fixate on the money won or lost, but to concentrate on the methodology and discipline. Then, it's said, the money will take care of itself. In Woodie's room, it's a cardinal sin to post the number of ticks or dollars made. I think most people are fine with this because, honestly, most people aren't making money. I'm going to stick with the daily tally of dollars (or at least ticks) as my personal preference. Win ratio is important in this profession for survival. It's a very raw indicator of success though. Money's the bottomline of all this, and it's always the ultimate tell.

I'm a 7 year trading veteran fulltime born-again newbie. I'm setting small incremental goals for myself, currently back to paper trading as I search for my missing mojo, but these goals necessarily culminate with money. This isn't a chatroom or messageboard where talking about dollars is untoward and eyed with suspicion. I'm not here for ego's sake, to win praise, envy or pity. I'm here to hopefully cut through the bull that clouds and distorts the average person's "self-reflections" by putting all this on cyberspace paper. My "goal" for the 2005 is the same I had for 2004, and that's to make a living as a futures daytrader. For the remainder of the year, I'm striving to go live once again (hopefully very soon) and with the eventual aim of netting $150-$200/day with a maximum of 10 ER trades. That would be $750-$1000/week and $3K-$4K/month. Those are real numbers that are achievable, I believe, and that won't make my family rich, but it would be give us a functional living, and I'd be mighty proud of that. In the back of my mind, those numbers also seem out of reach, but this is what taking small incremental steps is all about, and it's what having larger goals are all about. For the rest of 2004, I'd like to double my $5000 account (now $4990) to $10K. Doable? Anyway, my paper results are part of my baby steps and indicates to me whether or not I'm stepping in the right direction. Whether I post my money results here or not, I'll still know them, so they'll be here, too.

0 Comments:

Post a Comment

<< Home