RIP Superman

Woke up to the news that Christopher Reeve was dead. I remember as tiny kids, my brother and I were in the jacuzzi at my grandparents condo out here in LA, when who strolls by? Superman! It couldn't have been that long after the first Superman movie came out, so this was really big, larger than life shit to see him. He was walking with some other people, maybe being given a tour of the place as a prospective buyer, and he gave us that freeze frame Superman smile and he was gone. I guess you can't slap enough superlatives on the guy for his spirit and determination and all that, and they're all deserved.

RIP Super Dope

OTOH, there's Ken Caminiti, the self-admitted steroids using, alcoholic, crack addict 1996 National League MVP who dropped dead yesterday in The Bronx. Only reason to be in The Bronx is if you have tickets to a Yankees game, and apparently Cammy didn't. My brother used to work the ER at Lincoln Memorial where he wound up, and that's a shitty place to work and a shittier place to die. Sadly, here was a guy who wanted to give back to the game and mentor kids not to take the wrong path as he did, and now he's cemented his memory as the "anti-role model" as his name will always come up as the worst case scenario for athletes gone bad.

NYC

Let me complete the hat trick and mention my kid brother again. He's getting married in 3 weeks. We got a great last minute deal and flew back home to NYC to surprise everyone at a pre-wedding party. It was the first time back since we visited after 9/11, so it was a grand reunion. Plus, everyone was excited to see the baby. Now we get to do it all again for the wedding in Hawaii.

... and finally, trading:

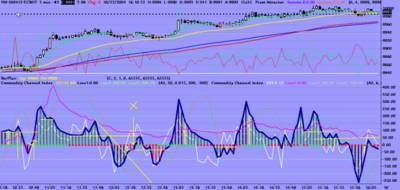

I had to wait a couple hours for my charts to start generating usable data this morning, then I tried to force off some trades to shake the rust off and reeled off 3 straight full stop losers on the YM for $160. All on paper, mind you. Then I stared at the tight range for another hour, before saying "fuck this." I walked 8 blocks to the post office and found out it was closed for Columbus Day. So there you go.

I had 3 books with me last week, including two by trading psychologist,

Mark Douglas, which I feel I should seriously re-read. I wound up only reading

The Da Vinci Code, which is a great book, but didn't have anything to help my trading (though it does mention fibonacci stuff). I also got a paperback,

Money is My Friend, which I could probably finish in a few hours if I seriously put my mind to it, then get in a couple hours of playback after dinner, instead of my great urge to take a nap now and then watch the Astros-Braves game.

My self-discipline is frittering away. I've got a Chris Reeve angel on one shoulder and a Ken Caminiti devil on the other. Superman is whispering in my ear, "Stop wasting your time. Be serious about your life and your goals. Don't give into laziness and cowardice." Cammy devil is saying, "Who gives a shit? You're sleepy, so take your nap! Tomorrow's another day to trade, so maybe you'll feel better then or next week, or next month, or fuck, we'll turn over a new leaf for 2005."