7 trades (5-2-0) for +$190 (-33.60 comm)

I'm pooped and should've called it a day earlier. Just got nicked on a WTF trade taken out of sheer boredom, so that's a sign to go do something more constructive like take a much needed nap.

I've been skimming some Woodie threads on

http://www.elitetrader.com/ as suggested by Coastal. They looked familiar. I haven't been to that msgboard in 6 months or so and only irregularly back then, but I'm aware of the bashing, defending and everything in between that goes on there. Regarding Woodie -- the man, and no one will ever accuse me of being a brown-nosing sycophant of anything or anyone or any idea in this universe, I admire him. Hard as it is to imagine in this cynical bullshitting world, but he's put himself out there to share what he successfully does and teach others his method simply out of the goodness of his heart. Disregarding (for the moment) the nuts & bolts of his methods, he's a remarkable fellow.

Many moons ago, I was reading

Tokyo Joe's wild, incoherant postings on one of AOL's stock boards. He used to pop into the Motley Fool chatroom on AOL to bash IOM (Iomega) which was a Fool favorite. Quite the character. He then formed a paid chatroom and I joined up. Now you talk about bastards, Tokyo Joe was the king. Still, people made crazy money with him, and even I made a buck or two. So even when he got exposed and nailed for pumping and dumping on the sheep in his room and for getting kickbacks and boatloads of stock from CEO's of penny stocks to pump them, I don't recall any significant venom being thrown his way from traders. More typical was the outrage why Tokyo Joe got picked on when

Cramer, his hedgie cronies, and every two-faced pumping bastard guest on CNBC was getting off scot-free or with a slap on the wrist.

So with this background in mind, I'm really shocked at the attacks on Woodie -- the man. Maybe if somebody had a shred of evidence that he was scamming somebody or fading his own chatroom or in anyway profiting off his sheeple in the room and seminar and trade-a-longs or whatever, I could understand the bitterness better.

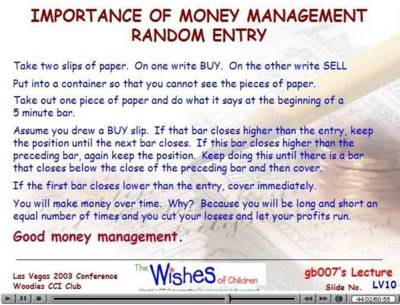

Now, as for the Woodie CCI techniques, effectiveness of the chatroom, etc, of course there's going to be varying degrees of success and failure. There's a million different ways to trade successfully. Here's a

Chinese menu of different setups. I'm sure somebody out there can find success with any of them, and I'm sure the vast majority will fail with all.

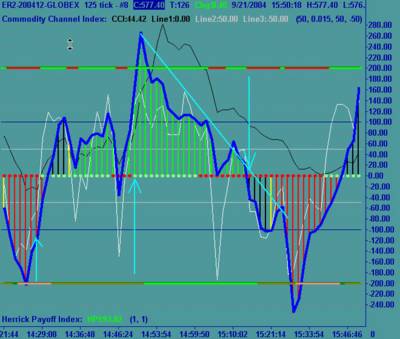

What I've seen with Woodie then (a year+ ago) and now is that while he's grown in popularity, there is a lot less of Woodie in everything now. He doesn't moderate everyday anymore. Each of these new moderators I'm seeing now have their own bastardized twist on the basic Woodie CCI. Why does Woodie allow this? I don't know. He's kinda lost control of things, and I suppose he doesn't care. Of all the Woodie instructive documents and chart efs and .dll's floating out there, Woodie's written none of them. Everyone's distorting things a bit around the CCI core, which is natural and to be expected. It's confusing for newbies who want the Woodie Way and hear him pounding the table on only using the CCI indicator, getting rid of prices, sticking to 1 time frame per vehicle, etc, then going into chat and having 1 or 2 or 3 different moderators each day with their 3 different ER charts with prices, MACD, flashing lights and whatnot.

Another change is that Woodie switched from Sierra to esignal charts. He forever preached about "why pay more? Sierra does the job." Now he has expensive esignal because they pledge to donate $50 to Make-A-Wish. That's great, but why should people pay $500 extra a year for charts to get that $50 donation? Now we've got a chatroom with half the people on Sierra, half on esignal, plus the strays on TS and others. The charts don't align. I swear the first half hour of the market day in chat is just people saying "my charts don't look like that."

The last major change I see is Woodie (and most mods) doesn't call out specific trades anymore. Everything is vague. Yes, the CCI system is discretionary, not mechanical. I, for one, don't expect to be spoon fed trades. Of course, I want to learn to fish, not be handed breaded fishsticks everyday. Unfortunately, hardly anyone announces their trades in chat anymore. There used to be a slew of people like NickTrader who gave entries/exits with reasons. Now the usual case is the occasional person boasting about their exit and profit only which is worthless to anybody. Then end of day, everyone chimes in with their "8 trades, all winners, thanks Woodie! CCI rocks! Good night!"

So how to effectively use Woodie's techniques and chatroom for my personal benefit? There are two roads to take as I see it. One road is to try and emulate Pure Woodieness. This isn't easy, as I've stated, Woodie is seriously diluted now. Maybe this road is preferable for total trading newbies who don't have other methods clogging up their minds, but it's harder and harder to learn directly from the horse's mouth. Seems even his trade-a-longs are now diluted with a swarm of "I'm not Woodie" mentors who'll help you in their "not quite Woodie" way.

The other path is to be open-minded and flexible and incorporate the CCI with your other stuff to effect your own "not quite Woodie" method that fits your own style, personality and bankroll. For the greater majority, Woodie isn't giving anyone the Holy Grail. His is just one selection on the Chinese Menu. For some people, it clicks as is, and it works as ideally advertised. For most, you have to learn it, take it apart, see what makes it tick, and then incorporate it into your own stuff or discard it. Chat is the same thing. You have to take what you can effectively use out of it. I'm finding the market hours commentary more and more useless, but the mod's voice is still a good background soundtrack for me (yes, even Gio's). Trading is lonely, so it's good to know I'm not alone. After hours, chat is good for technical questions and once in awhile a veteran will answer questions. Plus newbies come out of the woodwork to post trades during off-hours playbacks and I've found seeing how they're thinking is as instructive as seeing a veteran post their trades.

.jpg)